Getting reported that, desire charges can continue to vary from lender to lender. Therefore, the first thing to look for when evaluating SBA lenders is fascination fee and small business loan APR.

The Small Business Administration sets regulations and recommendations that lenders need to adhere to when issuing SBA loans. To qualify for an SBA loan, a business has to be a for-profit business situated in the United States or its territories. The business proprietor needs to have invested their particular time and expense within the business and should have fatigued all other financing alternatives.

He blends information from his bachelor's diploma in business finance and his private expertise to simplify complicated money subjects. Jordan's assure is actionable tips which is simple to comprehend.

At Western Alliance Financial institution, we’re known for our responsiveness and remarkable customer services. Our bankers provide the authority to make prudent lending choices immediately, with the power to cut through crimson tape that just doesn’t come about at large cash Heart banking companies. We look ahead to getting to know both you and your business.

All lending accounts are supported by a Relationship Manager who will information you through the application process and almost every other banking needs.

The conventional SBA seven(A) is the most common, and many functional SBA loan. Which has a loan number of as much as $5 million along with the widest range of employs, it could possibly benefit any business that’s eligible.

Time to fund: How much time does the application method choose? Understand that the fastest business loans aren’t always one of the most affordable.

Editorial Observe: We receive a Fee from companion links on Forbes Advisor. Commissions will not impact our editors' thoughts or evaluations. Getty Businesses that have to have to make a large buy to grow functions or create jobs might take pleasure in a U.

The listings highlighted on this site are from firms from which this site gets payment. This will influence the place, how As well as in what purchase these listings appear on This web site

On-line lenders could possibly be the most suitable choice to obtain a startup business loan without profits. Compared with brick-and-mortar financial institutions That always have stricter eligibility prerequisites, option lenders typically require just a few months in business. Other options beyond new business loans include crowdsourcing, self-funding or grant funding.

Should you’re in the market for property, prequalification also will let you compete from other purchasers and safe a assets previous to the formal application method.

The payment to file an yearly checklist is $150. Even so, you must also renew your business license when filing this once-a-year listing, which fees an additional $two hundred for each submitting. You can file your annual checklist on the net employing a Nevada SilverFlume account.

Just after acquiring a disbursement of resources from a line of credit history you can start to get a regular monthly invoice to produce repayments. Dependant upon click here your cycle date this may be as early as 21 days from disbursement or so long as 51 times just after disbursement.

A bank consultant are going to be reaching out for you Soon. Meanwhile, take a look at our most current information and insights.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Devin Ratray Then & Now!

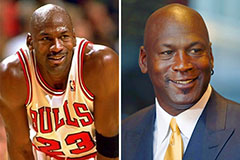

Devin Ratray Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Kane Then & Now!

Kane Then & Now!